Iraq’s Ministry of Oil opened up 29 oil and gas exploration blocks to companies hailing from 21 outside countries including China, Russia, Britain, the Netherlands, France, the UAE, Qatar, Malaysia, and Turkey. Surprisingly, Qatari and many European energy firms refrained from tabling bids. Shell and the Emirati company ADNOC did however step in with an offer to invest in the Dima oil field in Maysan, but they were outbid by Erbil-headquartered Kar Group, which offered 6.2% of the field's profits.

The Ministry of Oil successfully assigned 45% of the blocks and fields offered to international companies, with 8 Chinese firms securing development rights for 10 exploration blocks and oil and gas fields. Kar secured rights to 3 exploration blocks.

The majority of the allocated oil and gas blocks and fields are situated in southern Iraq, with exceptions including the al-Khaleesa gas block which straddles Anbar and Nineveh provinces, as well as the Sasan and Alan fields in Nineveh. This represents a departure for the Ministry of Oil, as it's the first time it has opted for production-sharing contracts over service contracts. Under these agreements, companies are granted shares ranging from 6.2% to 32% of the fields.

The fifth and sixth rounds have been unsuccessful as they centered on gas investment, which failed to attract interest. This suggests that Iraq won't achieve gas self-sufficiency within the next three years, as proclaimed by the Ministry of Oil on the initial day of these licensing rounds. Consequently, Iraq will need to rely on Iranian gas to power its plants for the foreseeable future.

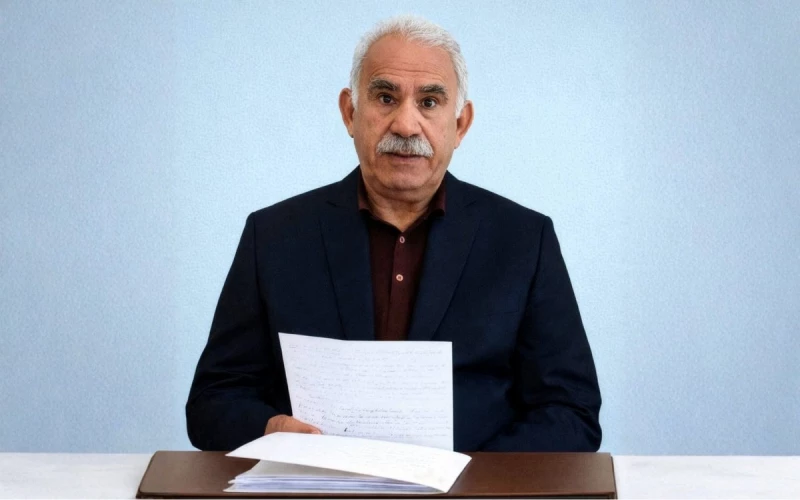

Oil Minister Hayyan Abdul Ghani announced that the supplementary fifth and sixth licensing rounds for the development of certain oil and gas fields, remain open to any company interested in applying for the unallocated projects. He pointed out that out of the 29 fields and exploration blocks presented to the 22 companies, only 13 were allocated, leaving 16 blocks and fields available to investors. Iraq's Minister of Oil Hayan Abdul Ghani al-Sawad speaks during the launch of the fifth and sixth licensing rounds for 29 oil and gas fields, at the Oil Ministry headquarters in Baghdad on May 11, 2024. (Photo by MURTADHA RIDHA / AFP)

Iraq's Minister of Oil Hayan Abdul Ghani al-Sawad speaks during the launch of the fifth and sixth licensing rounds for 29 oil and gas fields, at the Oil Ministry headquarters in Baghdad on May 11, 2024. (Photo by MURTADHA RIDHA / AFP)

The ministry aims to conclude contracts with the winning companies over the next two months. It anticipates Iraq's oil reserves to rise to 160 billion barrels, a 20-billion-barrel increase after development. Today, Iraq's production capacity stands at 5.5 million barrels per day. However, adherence to the OPEC+ agreement and Iraq's voluntary cuts have reduced current production to 4 million barrels per day.

The Iraqi government is facing criticism for its ineffective marketing of the current licensing rounds and its failure to attract reputable foreign companies. There's also censure for a failure to harness local human resources in oil field development. In the initial and subsequent licensing rounds in 2009, major international players like Exxon Mobil, BP, Lukoil, and Shell were engaged.

In a statement, Basem Taher, Director of Contracts and Licensing at the Ministry of Oil, highlighted that major players such as Shell, Lukoil, and others showed limited interest in investing in the fifth and sixth round fields, despite being aware. Their offers, he said, did not offer Iraq value for money offered. Taher further noted that Chinese companies presented appropriate offers and succeeded in securing the majority of the oil fields.

A representative submits his company's offer during the launch of the fifth and sixth licensing rounds for 29 oil and gas fields, at the Oil Ministry headquarters in Baghdad on May 11, 2024. (Photo by Murtadha RIDHA / AFP)

Energy sector expert Ali Da’doush expressed concern over Iraq's failure to attract American and European companies to invest in the energy sector, emphasizing the grave implications for the economy's future. Da’doush noted the withdrawal of global giants like Exxon Mobil, Shell, and others from Iraq, particularly from the southern region, signaling Iraq's diminishing appeal to international investors and posing a significant threat to the economy's prospects.

Da’doush expressed astonishment at the failure to invest in Iraqi human resources to establish a national oil company capable of field development, instead of entrusting them to obscure Chinese firms on a global scale. He highlighted that while the Ministry of Oil had previously rebuffed participation contracts inked by the Kurdistan Regional Government with international oil firms, it has now adopted a similar approach with Total, the French company, and the winners of the fifth and sixth rounds.

Economist Mohammed Majed emphasized in a private statement that it's imperative for the Iraqi government to recognize the resolution of oil companies' disputes with the Kurdistan Region and acknowledge the participation contracts inked by the Kurdistan Regional Government with these companies to initiate oil exports. He highlighted that while the ministry's previous stance was centered on service contracts, it has now shifted to participation contracts with Chinese firms, offering them high profitability, up to 32%.

Facebook

Facebook

LinkedIn

LinkedIn

Telegram

Telegram

X

X