Between mounting pressure from the United States and a sudden decision by OPEC to increase oil production, the price of oil has plunged to its lowest value in four years. Specifically after US President Donald Trump introduced new tariffs on imported goods, various markets across different sectors have seen a downward curve in production and value, lowering the demand for energy, and thus oil, resulting in lower oil prices in turn.

A plunge in oil prices represents a dangerous alarm to the Iraqi economy. Baghdad, generating over 90 percent of its annual income through oil production and export, relies heavily on oil as its main source of revenue; hence, any sudden change in oil prices will have a direct impact on the country's revenue, and by extension, the livelihood of its population.

Iraq has set the price of one barrel of oil at 70 US dollars in its 2023-2025 budget, with an estimated volume of shortages projected at 64 billion dollars, implying that any deviation from the 70-dollar-per-barrel projection will have dire consequences on Iraq's budgetary shortages.

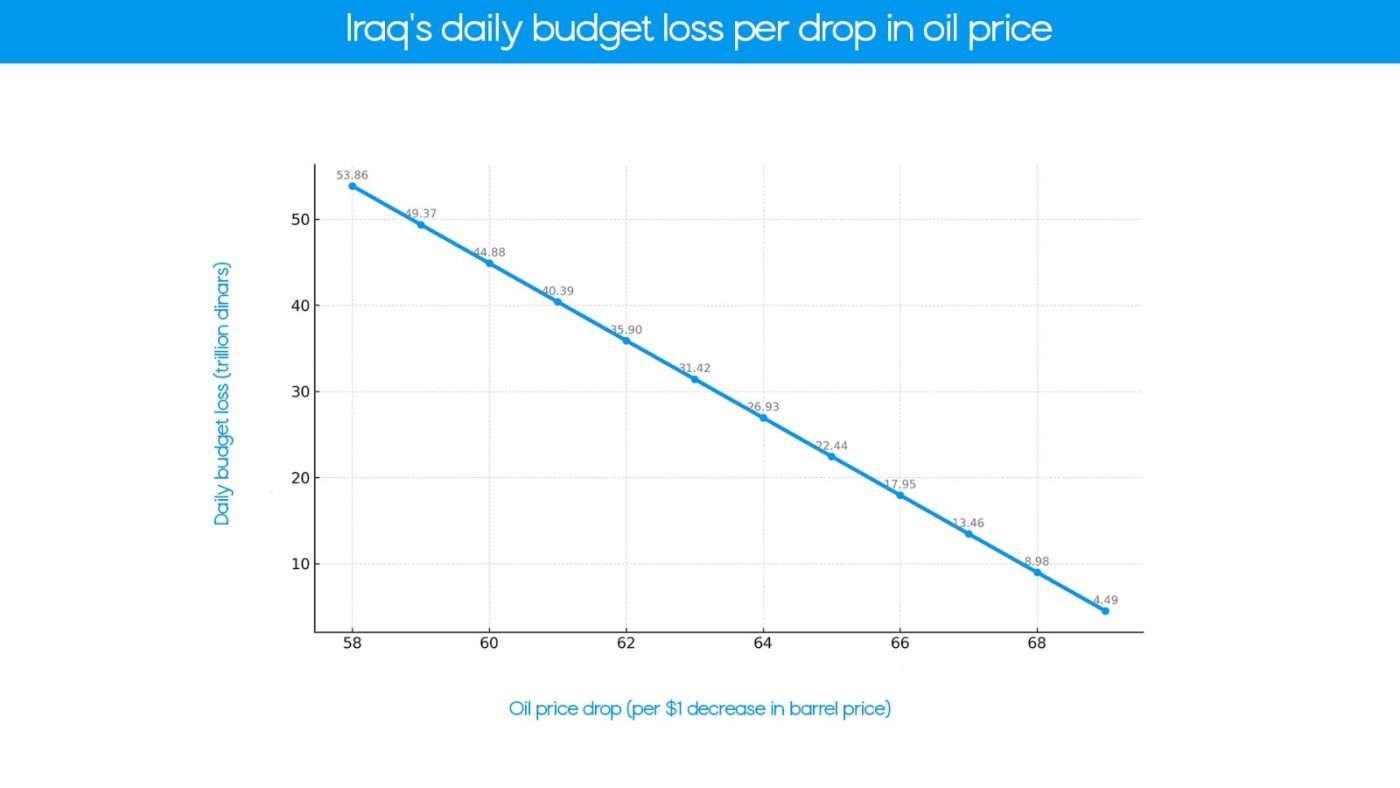

In simple terms, Iraq exports roughly 3.2 to 3.4 million barrels per day; a drop in oil prices of only one dollar per barrel would lose Iraq between 3.2 and 3.4 million dollars per day. Iraq, which has set the value of its dinar compared to US dollars in its budget at 1320 per dollar, will lose 4.48 billion dinars a day if oil prices drop by one dollar.

The more oil prices plunge, the more prominent Iraq's budgetary shortages will deepen, as portrayed in the graph below:

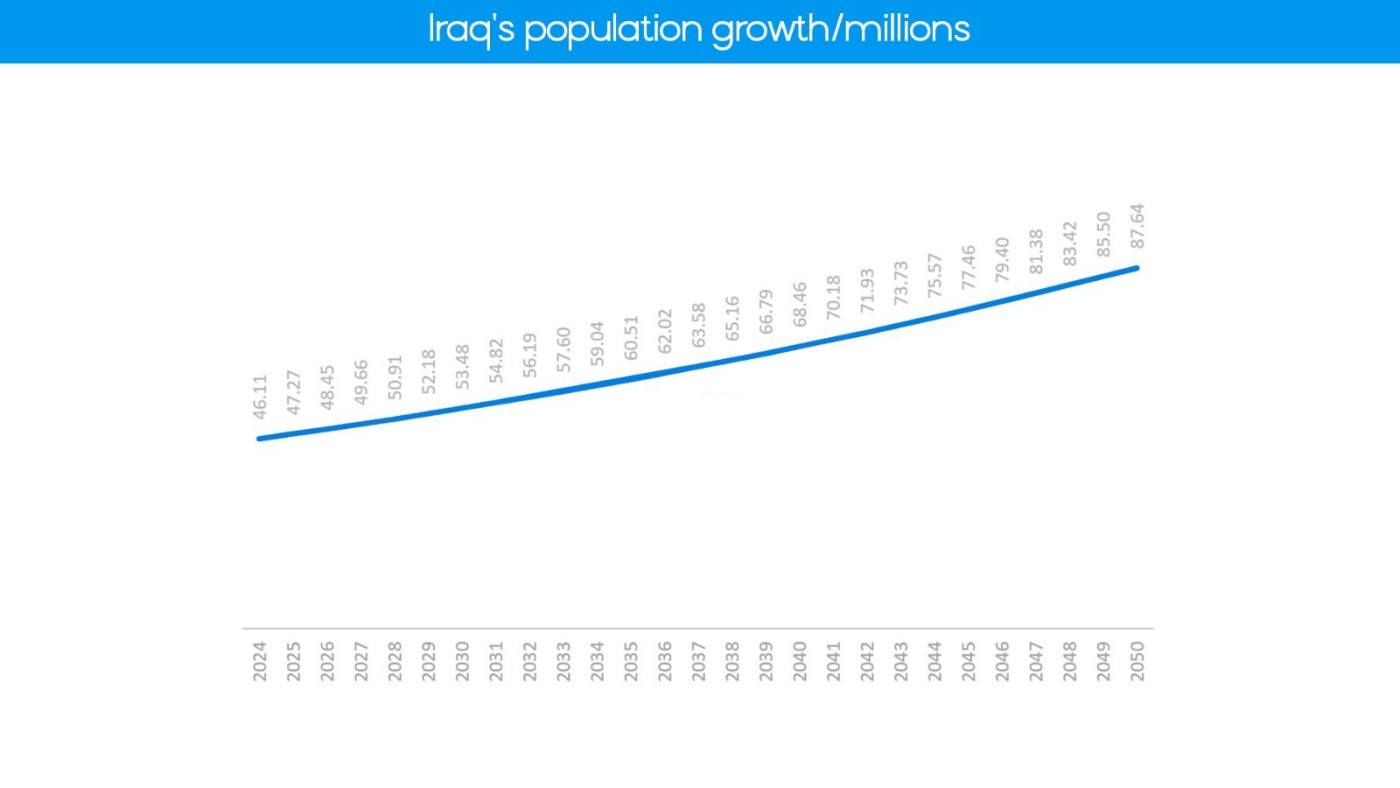

The threat doubles when considering the results of the recent census Iraq conducted, which estimates the population of the country at over 46.1 million. If we take the population growth rate at 2.5 percent, Iraq's population by 2050 will reach over 86.6 million, according to the following equation:

P(t)=P0 ×(1+r)t

According to the Budget Law's operating expenses, around 70 percent of Iraq's budget is estimated to be spent on civil servant salaries, which are estimated to cost Baghdad 133 trillion dinars of its 198 trillion dinar annual budget. The census finds Iraq's civil servant employees to comprise 38.25 percent of the population, accounting for 70 percent of the country's budgetary expenses.

The Paris-based International Energy Agency (IEA) expects a drop in oil prices to 50 to 70 dollars per barrel in light of growing global interest in renewable sources of energy, with projections of oil prices dropping to 30 to 50 dollars per barrel by 2050.

The census finds that children under the age of 5 compose 11.16 percent of Iraq's population, while 24.74 percent of the population is aged between 5 and 14 years.

If we take Iraq's current government-employed civil servant rates of 38.25 and project the same rate to Iraq's 2030 expected population, the number will reach nearly 20.5 million, severely adding to the strain on Iraq's budget.

If the estimated drop in oil prices plays out as expected, Iraq's economy is facing a risky storm that might not only hamper the country's ability to sustain its current habitual spending but also sentence Baghdad to a future of debt and financial struggles.

Facebook

Facebook

LinkedIn

LinkedIn

Telegram

Telegram

X

X